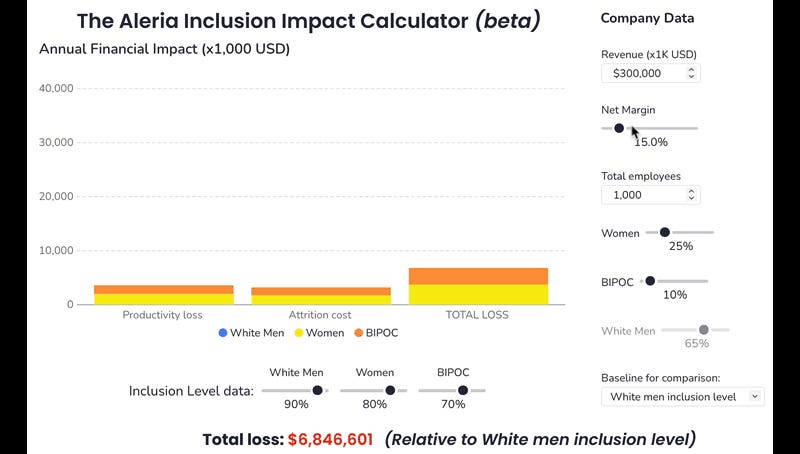

Animated screenshot of the Aleria Inclusion Impact Calculator

Paolo GaudianoThis blog introduces a simple way for any organization to estimate the financial impact of inclusion. The ideas described in this blog are captured in an interactive Inclusion Impact Calculator that readers can try for themselves.

At the heart of the calculator is the assumption that inclusion is directly linked to satisfaction, which in turn impacts productivity and retention. If an organization is less inclusive, its employees will be less productive, which impacts top line financials. In addition, less satisfied employees are more likely to leave, which leads to increased costs because of rehiring.

How to use the calculator

Briefly, to use the Inclusion Impact Calculator you specify revenues, profit margins, number of employees, diversity levels and inclusion levels of your organization. The calculator estimates how much money is being lost through reduced productivity and increased hiring costs. Additional details are provided at the end of this blog post.

For simplicity, this version of the calculator uses only three identity groups: white men, women, and BIPOC (Black, Indigenous, and People Of Color). This is not meant to discount the importance or nuances of different identity groups, and it would be easy to add more identity groups if desired and if data were available. However, the overall results hold regardless of the exact details of diversity in the organization.

Note that the percentage of white men in the calculator is automatically adjusted based on the representation levels of women and BIPOC, so that the total is always 100% as the other two sliders are adjusted.

If you don’t have inclusion data, you can use satisfaction data, or simply leave the values at their defaults.

The calculator also includes a drop-down selector that lets you calculate and show the financial impact by comparing the level of inclusion of women and BIPOC either to (1) the level of inclusion of white men, i.e., an equitable organization in which all employees enjoy the same level of inclusion, or (2) an “ideal” organization in which everyone enjoys 100% inclusion, i.e., an organization that is fully equitable and fully inclusive.

As you change any of the parameters, you will notice that the “Annual Financial Impact” chart at the top of the page changes interactively. The chart shows three columns, which represent the amount of money lost as a result of lost productivity (left column) and attrition costs (middle column), as well as the total financial loss (right column, which is just the sum of the two left columns).

Each column is made up of two or three stacked segments, corresponding to the identity groups. If the drop-down selector is set to “White men inclusion level,” there will only be two segments, one for women (in yellow), one for BIPOC (in orange). On the other hand, if the drop-down is set to “Fully inclusive organization,” then a third blue segment will appear, showing the loss from the less-than-perfect inclusion level of white men.

The chart is scaled so that its maximum value is equal to the net profit, which is calculated as total revenues times net margin. This makes it easy to see how the reduced level of inclusion impacts profitability.

Things to notice

When you first open the calculator, it should be showing the following default parameters: revenues of $300 million (note that all dollar values are divided by 1,000 for clarity); net margins of 15% (i.e., net profit of $45 million); 1,000 total employees, of whom 65% are white men, 25% are women and 10% are BIPOC; inclusion levels of 90% for white men, 80% for women and 70% for BIPOC. The annual financial impact is based on comparison with the inclusion level of white men.

Under this baseline scenario, the company is losing almost $7 million compared to what it could hypothetically make if it were fully equitable. This amounts to about 15% of its net profits.

Changing the drop-down selector in the lower-right corner to “Fully inclusive organization” shows that the organization is losing more than $22 million relative to a fully equitable and inclusive organization (if all employees enjoyed 100% inclusion).

It is worth noting that these numbers are not unreasonable. For example, in late 2022 a leaked internal memo showed that Amazon was estimating annual losses of about $8 billion due to unwanted attrition in its Consumer Field Operations, against net profits of about $33 billion.

Another thing to notice is that increasing the level of diversity without changing the inclusion levels actually leads to greater losses. This is because if you increase, say, the percentage of women, but do not take steps to make the workplace more inclusive, you will end up with a higher proportion of dissatisfied employees, and thus a higher cost.

This is a very reasonable result that underscores the importance of focusing on inclusion first, rather than on diversity first. In fact, our research has demonstrated conclusively that increasing inclusion leads to greater diversity by virtue of the fact that greater inclusion leads to lower attrition, which leads to higher representation.

More evidence that inclusion should be your top priority

For some years I have been arguing that inclusion is a necessary precursor for any organization to become more diverse and to achieve superior performance. I have also suggested that focusing on diversity alone is dangerous, and can actually backfire. In contrast, focusing on inclusion removes the negative feelings and zero-sum-game mindset that fuel much of the backlash and claims of reverse discrimination.

Some DEI experts have expressed frustration that leaders continue to ignore “the business case for diversity.” This is based on the widely accepted thinking that diversity in and of itself is beneficial to organizations. However, close scrutiny strongly suggests that the claims about the inherent value of diversity are questionable if not entirely flawed.

As this blog demonstrates, it is much easier to argue the business case for inclusion, by showing each leader how becoming more inclusive can increase the financial performance of their organization, not simply how this works on average across large numbers of organizations.

Supplemental information: how the calculator works

The Inclusion Impact Calculator estimates cost based on two factors: lost productivity and increased attrition. This version of the calculator is based on a set of simplifying assumptions.

1. All employee-related parameters (salary, inclusion, productivity, attrition) are specified and used as the average for each group.

2. The level of satisfaction of an individual employee is directly proportional to their level of inclusion (this has been found empirically in our work with dozens of organizations)

3. The level of inclusion (and thus satisfaction) impacts productivity, which in turn impacts revenues.

4. The level of inclusion (and thus satisfaction) impacts attrition, which in turn impacts attrition costs.

5. The cost of unwanted attrition is estimated as one year’s worth of salary.

6. Average salary is calculated by estimating total salaries to be 25% of revenues, and dividing that by the number of employees.

The calculator also makes some other assumptions about how inclusion impacts productivity, how much of the individual productivity impacts revenue generation, and how much inclusion impacts attrition.

The interactive calculator was created with the cloud-based platform Grid.

We are grateful to Meng Cao for his help in developing this calculator.