You’ve finally reached the retirement date that’s been circled on the calendar for the past 5 years. You’ve done everything you’re supposed to do and have accrued a nice pension, a plan for social security, and a healthy balance in your Thrift Savings Plan, or other investment accounts. Maybe you’ve even done some tax planning and have a portion of your money in Roth accounts.

The race that you’ve been running your whole working life is over, and you feel like you’ve won.

Or is it? In reality, you’re only halfway through the race, and it can get even more complex from here.

As important as it is to save for retirement, making those savings work for you in the most efficient way takes a lifetime of planning and strategy.

For federal employees, retirement planning can be particularly nuanced due to factors like the pension, TSP and other unique benefits.

So, how do we use this nest egg that we’ve worked so hard to grow in the most efficient way? How do we invest now that we also need to preserve that money? Can we still afford to take risks in the market now that we’re retired, or should we make everything more conservative?

For our clients, we use something called the “Bucket Strategy” to outline their retirement spending and make sure every dollar is being put to its best use.

Sequence of Return Risk

The stock market is a powerful tool that allows our money to work for our benefit and compound over time, but the price we pay for that growth is volatility. The stock market may have positive average returns over time, but that doesn’t mean every year is positive.

As a matter of fact, one of the biggest mistakes that people make when entering retirement is that they assume “straight line” returns instead of preparing for the fact that the market could be down in their first year or two of retirement.

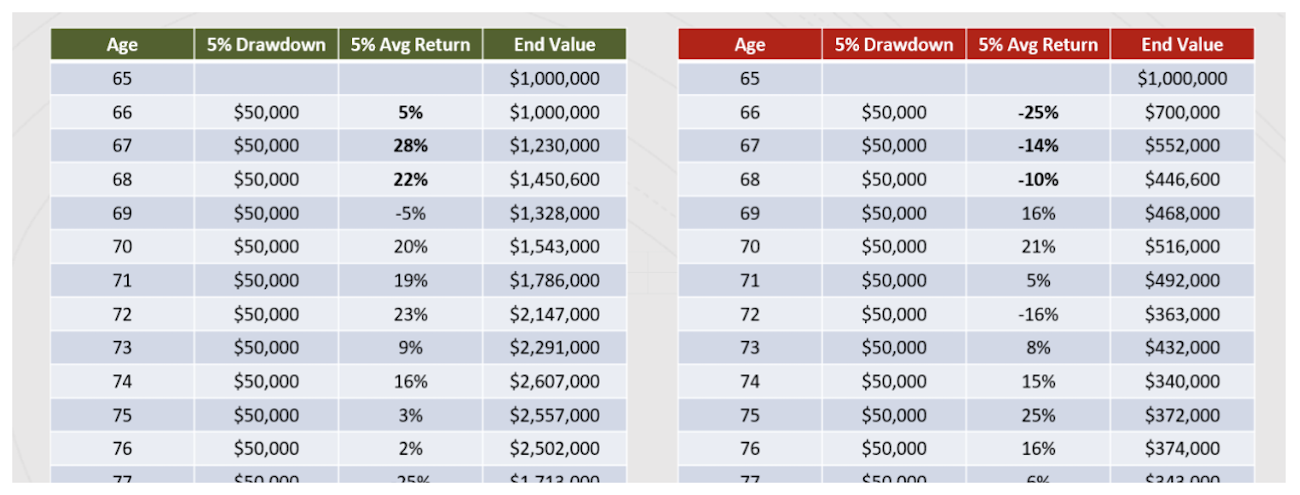

Take a look at the following example.

Retiring at 65 with $1m seems like a slam dunk. But what if your retirement lines up with a recession and the market is down for the first 3 years?

Even though the average return is 5% in both scenarios, since the first 3 years were negative in the second scenario, it resulted in substantially less money available by the late 70s.

If your retirement plan requires $50k from your portfolio each year, that doesn’t necessarily change just because the market is down.

And that’s where the “Bucket Strategy” comes in. The entire purpose of this strategy is to have money allocated so that you never have to withdraw from the market when it’s down.

The Bucket Strategy

The Bucket Strategy is a simple yet powerful approach to managing retirement withdrawals, providing both stability and growth potential over the long term. Let’s break down how it works and why it can be especially beneficial for federal employees:

Income Planning: Before implementing the Bucket Strategy, it’s essential to assess your retirement income needs. Determine how much you’ll need from your retirement savings each year in the future. This is not your total expense. This is just what you’ll need after your pension, Social Security, and other guaranteed income sources have paid.

To do this, you’ll need to have a relatively accurate estimate for your expenses – including essentials like housing, healthcare, and daily living, as well as discretionary spending for travel, hobbies, and other activities.

Time-Bound Categories: Once you have a clear understanding of your income needs, divide your retirement withdrawal requirements into three time-bound categories based on when you’ll need the funds:

- 1-3 Years: Allocate funds needed within the next 1-3 years into this category. These funds should be kept in very conservative, liquid investments such as cash, money market accounts, short-term bonds, or certificates of deposit.

The goal of this “bucket” is to preserve capital and ensure easy access to funds for short-term expenses without exposing them to market volatility.

- 4-6 Years: Funds needed within the next 4-6 years should be allocated to relatively conservative investments. While still prioritizing capital preservation, you can consider investments with slightly higher potential returns than cash equivalents. Examples include mid-term bonds or a conservative-to-moderate allocation within your TSP or outside investment account.

- 7+ Years: Funds not needed for 7 or more years can remain more aggressive. This category can include a diversified mix of stocks, bonds, and other growth-oriented investments within your TSP and other retirement accounts. Since these funds have a longer time horizon, they have the potential to withstand market fluctuations and benefit from long-term growth.

Withdrawal Flexibility: The beauty of the Bucket Strategy lies in its ability to provide a steady stream of income while allowing you to weather market downturns without selling investments at a loss. By having sufficient cash reserves in the short-term bucket, you can fund your living expenses without relying on selling investments during market downturns. Meanwhile, the longer-term buckets can remain invested, giving them time to recover from market downturns and potentially grow over time.

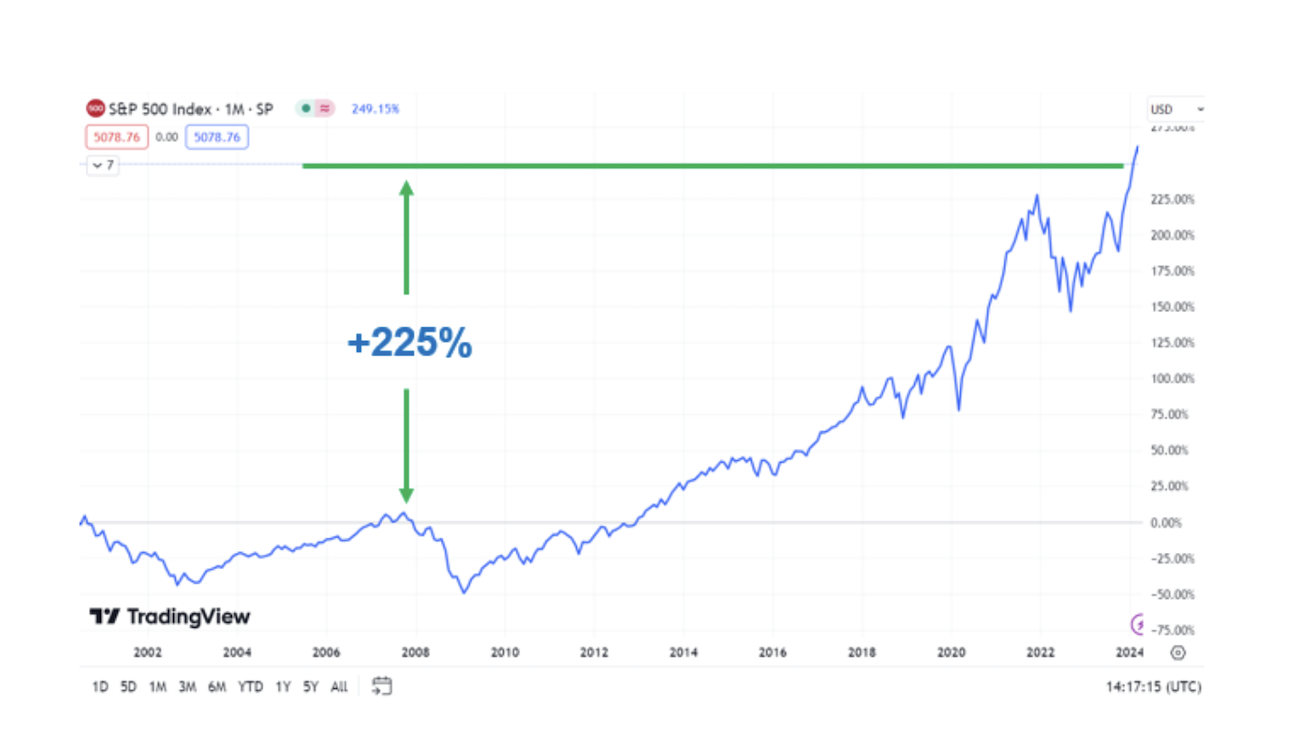

To put this in perspective, the 2008-2009 market crash around the Great Recession had an initial peak in October 2007, before the S&P 500 fell 50%+ and bottomed out in February 2009. But, if you remained invested through all of that, you would have made your money back by February 2013.

That’s about 5.5 years from the top of the market, through the crash, and back to where you break even again.

Therefore, if you have enough “conservative” money to get you through 6-7 years, it should allow your more aggressive money to ride out even an extreme market event like the great recession.

And what’s the benefit of leaving some of your money more aggressive?

Well, if you would have invested at the “worst” possible time in October 2007, but left your money invested until 2024, you would have more than tripled your account value.

If you’re lucky, your retirement is going to last a long time. Using this strategy allows you to preserve enough of your money to maintain your cashflow, while the rest of it potentially grows so it can continue to benefit you and your loved ones.

The TSP Shortfall: Unfortunately, the Bucket Strategy is very difficult to implement within the TSP. Since all TSP withdrawals are taken proportionately from each of your investments, you can’t dedicate one particular fund as your short-term “bucket” and only draw from that fund for the next 3 years.

On the other hand, with accounts outside of the TSP, you can pick and choose which investments you sell. This could allow you to only sell from bonds if the stock market is down, or vice versa.

The TSP has a lot of great qualities, but this is one example of why some retirees consider moving money into IRAs in retirement.

Regular Review and Rebalancing: As with any investment strategy, it’s crucial to regularly review and rebalance your buckets to ensure they align with your evolving financial needs and risk tolerance.

If the market is doing well, you may decide to take distributions from your more aggressive “buckets” or use them to “refill” your short-term accounts. This is a dynamic strategy and is meant to be tracked and maintained throughout your retirement.

By implementing the Bucket Strategy for retirement account withdrawals, Federal Employees can have the confidence knowing they have a structured approach to managing their retirement income while maximizing the growth potential of their savings.

Consult with a financial advisor experienced in retirement planning to tailor this strategy to your specific financial situation and retirement goals. With careful planning and disciplined execution, you can set yourself up for a financially secure and fulfilling retirement.

Austin Costello is a certified financial planner with Capital Financial Planners. If you don’t feel confident in your current or future retirement withdrawal strategy and would like feedback, you can register for a complimentary check up. For topics covered in even greater depth, see our recorded webinars.