This chemical stock could be signaling a bullish reversal. How to use options to play the bounce

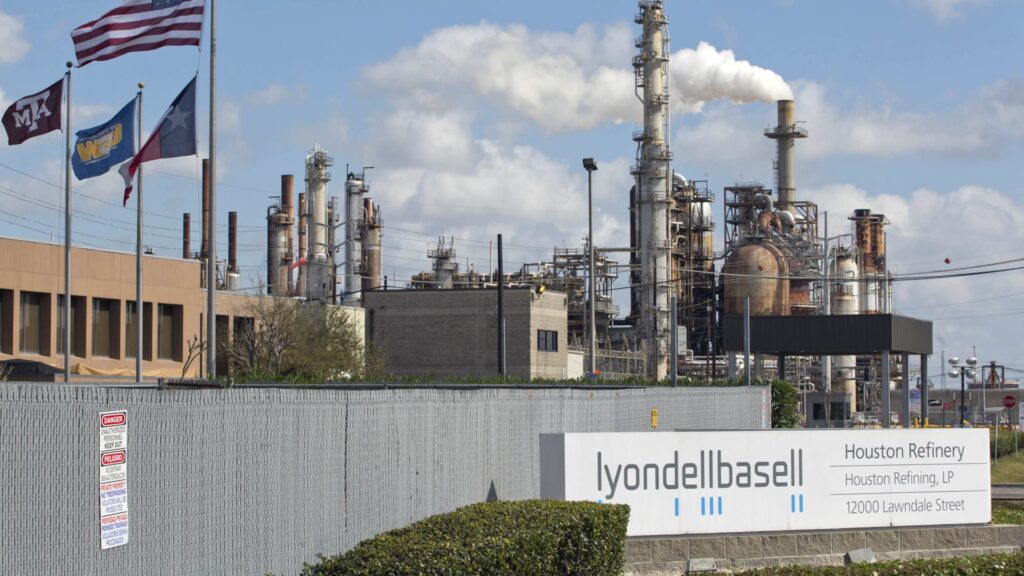

LyondellBasell (LYB) , the 3rd-best-performing stock in the Russell 1000 on Wednesday, is a cyclical name that may be signaling a bearish-to-bullish reversal. The stock was punished through 2025 as the global chemicals chain wrestled with weak demand and ongoing overcapacity — especially in Europe and Asia — driving compressed margins and investor skepticism. In […]

Goldman Sachs CEO looks at how to get involved in prediction markets

Goldman Sachs CEO David Solomon speaks during an interview at the Economic Club of Washington, Oct. 30, 2025. Kevin Lamarque | Reuters Goldman Sachs CEO David Solomon said Thursday the giant Wall Street investment bank is actively exploring opportunities in prediction markets, signaling growing institutional interest in a corner of finance that has gained increased […]

This oil drilling stock is remarkably cheap. How to trade it with options

The “Dogs of the Dow” is an investment strategy, often employed at the end of a year in anticipation of some potential “mean reversion” that identifies underperforming stocks with high yields. As the name implies, it looks for these within the Dow Jones Industrial Average . The strategy then holds those securities for a year […]

This cybersecurity stock is emerging as an AI play. How to play it with options

Akamai is emerging as an upcoming AI beneficiary with a business transformation that is materially reshaping its long-term growth trajectory. Historically known as a content-delivery (CDN) provider, Akamai has recently repositioned itself as an edge-native cloud and AI compute platform, leveraging its global infrastructure footprint to offer lower-latency, lower-cost inference workloads. This transition is finally showing […]

Carvana shares have no room for error. How to make money if they start falling

Carvana’s share price has staged a stunning comeback. The recent news that the company would be added to the S & P 500 propelled the enterprise value to more than $100 billion, a number that not only vastly exceeds those of large auto dealers like Penske , Lithia , AutoNation , Group 1 and Carmax […]

Disney’s chart is pointing to a rebound. How to capture a trading profit using options

Disney (DIS) shed nearly 13% in just nine trading sessions following its recent earnings report, where flat revenue numbers spooked investors despite a solid bottom-line performance. However, the narrative is shifting. The stock staged a solid rebound last week and is now flashing strong signs of a technical recovery. While the bounce is already underway […]

How to play further gains in copper using options on this mining stock

The sharp rally in gold and silver can be read as a market referendum on the credibility of paper money. Large, persistent government deficits imply that future financing may rely on a mix of higher taxes, financial repression and — most relevant here — central banks keeping borrowing costs contained. When investors suspect that debt […]

This stock tied to U.S. housing could be in trouble. How to make money through options

Despite Fortune Brands Innovations (FBIN) optimistic name, investors may want to approach the stock with caution. The company, which manufactures plumbing fixtures, cabinets and security products through brands like Moen and Master Lock, faces a convergence of headwinds that may leave little upside. The housing market remains the elephant in the room. Fortune Brands derives […]

How to use the tax-loss selling occurring now to pick up quality stocks on the cheap

It’s that time of year again: the annual tax-loss harvest. It’s happening across the brokerage firms right now, and it’s happening in size. Advisors are locking in losses to offset the big realized gains from earlier in the year, especially back in April when clients trimmed their winners and booked profits. We know from trading […]

The healthcare sector is having its market moment. How to find the Best Stocks in the space

(This is The Best Stocks in the Market , brought to you by Josh Brown and Sean Russo of Ritholtz Wealth Management.) Josh — In a technology innovation cycle like the PC revolution, dotcom, wireless, dotcom 2.0, cloud computing, AI, etc, investing broadly across the category makes sense because as spending rises, the tide lifts […]