Home Depot has been in a steep downturn since mid-September. How to use options to bet on a bounce

Home Depot (HD) has been in a steady slide, down about 12% over the last 18 days. While the downtrend is still intact, price is reaching a level where a mean-reversion bounce could set up. If support holds and momentum turns, this week might offer a defined-risk shot at a potential trend reversal. Support/Resistance Note […]

'Fast Money' traders on how to trade AI stocks – CNBC

'Fast Money' traders on how to trade AI stocks. CNBC's “Fast Money” team discusses the stock charts of two AI companies and their strategies for … Source link

This insurance stock is breaking out, but remains cheap. How to get long with options

Elevance Health is emerging from a 2025 reset with improved positioning to restore margins and grow its earnings base. Management has demonstrated discipline by lowering guidance to reflect elevated costs rather than delaying recognition, clearing the decks for the future. At the same time, the Carelon platform continues to deliver robust growth, diversifying revenue streams […]

As the market pulls back, Jim Cramer explains how to handle sell-offs

CNBC’s Jim Cramer unpacked Tuesday’s market action and suggested that it can be worthwhile to stick with good stocks as they weather losses, telling investors to buy, not sell, into weakness. “When you get hit with a sell-off…that’s when you should buy more of your favorite growth stocks…the ones you’ve done the homework on and […]

AI bull marks the revenge of the Dotcom ‘boxmakers’ like Cisco, Dell. How to trade the stocks from here

(This is The Best Stocks in the Market , brought to you by Josh Brown and Sean Russo of Ritholtz Wealth Management.) Josh — I remember being a retail stockbroker in 1999, pitching shares of Mellon Bank to my retail brokerage customers. After the repeal of the Glass-Steagall Act under President Bill Clinton, a wave […]

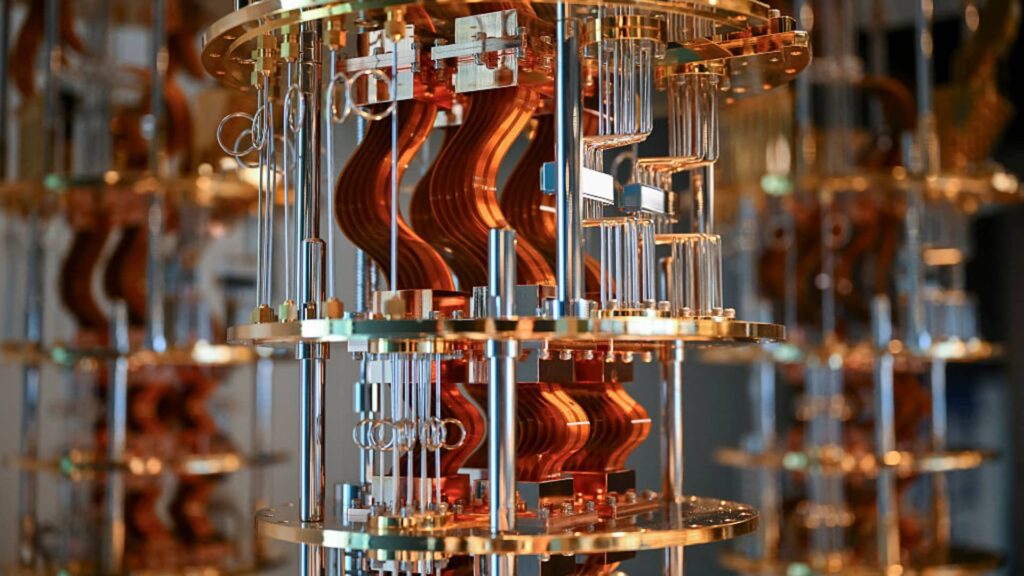

There’s a new potential quantum computing king. How to invest in it with less risk using options

IBM is not your grandfather’s “big blue” stock anymore. The company has quickly blossomed into an essential leader in the quantum computing world. I want to own IBM using options to capture this potential new quantum computing “king”. IBM’s leadership, particularly under CEO Arvind Krishna, has transformed the company by making bold initiatives to divest […]

Investors aren’t quite sure how to react to the Fed’s quarter-point cut

Federal Reserve Chair Jerome Powell takes questions from reporters during a news conference following a two-day meeting of the Federal Open Market Committee at the Federal Reserve on Sept. 17, 2025 in Washington, DC. Chip Somodevilla | Getty Images The U.S. Federal Reserve on Wednesday stateside cut interest rates by a quarter point, bringing the […]

Why regular investors should embrace high-priced stocks — how to do it

Here’s our Club Mailbag email [email protected] — so you send your questions directly to Jim Cramer and his team of analysts. We can’t offer personal investing advice. We will only consider more general questions about the investment process or stocks in the portfolio, or related industries. This week’s question: Hi Jim, I just joined the […]

How to trade an improving outlook for bank stocks going forward

(This is a wrap-up of the key money moving discussions on CNBC’s “Worldwide Exchange” exclusive for PRO subscribers. Worldwide Exchange airs at 5 a.m. ET each day.) Traders are keeping an eye on financials as the sector’s backdrop improves. Investors are also awaiting key revisions to U.S. labor data due out later in the day. […]

Applovin is soaring. How to tell if the breakout is for real

AppLovin (APP) surged to new all-time highs Monday, gaining 12% and adding roughly $14 billion to its market capitalization, as it officially joined the S & P 500 Index. The breakout through final resistance is a bullish technical development, acting as a positive catalyst and clearing the chart of overhead supply. Breakouts are most reliable […]