How to diversify your crypto portfolio

00:00 Speaker A There is this push to launch more crypto ETFs. We’ve seen various, uh, you know, brokerage firms saying that this is something they want to do more of. But money flowing out of those ETFs like we just said, is that a concern at all when it comes to supply and demand […]

Haven’t started on your tax return and feeling overwhelmed?

Despite being something most of us tackle every year, lodging a tax return can easily end up at the bottom of your to-do list. “Many families are experiencing financial stress during this cost-of-living crisis and, for some people, lodging their tax return may feel overwhelming,” says Zena Burgess, CEO at the Australian Psychological Society. “People […]

How to make money from your phone

Looking to boost your income? The key to earning more money could already be in your hands. Literally. Your smartphone may be the ticket to picking up a side gig and supplementing your income with some extra cash for food, utilities, or other basic expenses. There aren’t many people who fully utilize their phones to […]

How to boost your super at tax time

Tax time is fast approaching — but there is still time to get your ducks in a row if your superannuation is on your list of admin tasks to tackle. Tax agents say it is a good time to look at maximising your super, using something called ‘concessional contributions’, which can lower your taxable income […]

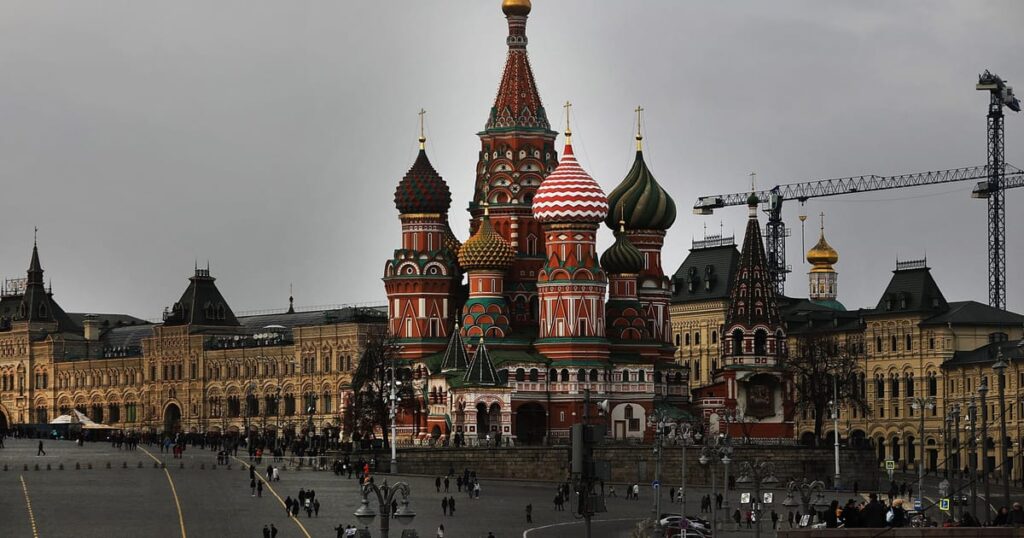

How to use Russia’s central bank assets for Ukraine – POLITICO

A simple solution that addresses all of these concerns is available. To avoid the risk of Russia’s central bank assets unfreezing and returning to the hands of the Kremlin in July, Europe needs to use the countermeasures argument and put the assets beyond Moscow’s reach. This can be done by transferring them to a new […]

Tax bills & IRD: How to legally reduce your tax burden before year’s end – Diana Clement

For most wage and salary earners, tax deductions will be correct and the Inland Revenue Department’s (IRD) annual automatic tax assessments will ensure that any refunds find their way into taxpayers’ bank accounts automatically. It’s worth checking that you’re on the right tax code. If you selected the wrong tax code when starting a job, […]

How to get the money for Europe’s defense – POLITICO

Currently, the EU spends a third of its entire budget on climate policy. Just last year, the price tag for buying things like solar panels, wind turbines, transmission lines, electric cars and chargers was €367 billion — this amount alone could fund Europe’s need for defense spending. The EU’s extremely high energy prices also drain […]

How to Claim West Virginia’s New Vehicle Tax Rebate for 2024 | WV News

State AlabamaAlaskaArizonaArkansasCaliforniaColoradoConnecticutDelawareFloridaGeorgiaHawaiiIdahoIllinoisIndianaIowaKansasKentuckyLouisianaMaineMarylandMassachusettsMichiganMinnesotaMississippiMissouriMontanaNebraskaNevadaNew HampshireNew JerseyNew MexicoNew YorkNorth CarolinaNorth DakotaOhioOklahomaOregonPennsylvaniaRhode IslandSouth CarolinaSouth DakotaTennesseeTexasUtahVermontVirginiaWashingtonWashington D.C.West VirginiaWisconsinWyomingPuerto RicoUS Virgin IslandsArmed Forces AmericasArmed Forces PacificArmed Forces EuropeNorthern Mariana IslandsMarshall IslandsAmerican SamoaFederated States of MicronesiaGuamPalauAlberta, CanadaBritish Columbia, CanadaManitoba, CanadaNew Brunswick, CanadaNewfoundland, CanadaNova Scotia, CanadaNorthwest Territories, CanadaNunavut, CanadaOntario, CanadaPrince Edward Island, CanadaQuebec, CanadaSaskatchewan, CanadaYukon Territory, Canada Zip Code Country United States of […]

How to dodge Labour’s double tax attack on pensions

The main purpose of a pension fund is to provide you with a comfortable retirement for your life and that of your spouse or partner so that you do not become a burden on others or indeed the state. Once this is secured, it becomes safer to make lifetime gifts to your children, the main […]

Senior Citizen Savings Scheme: How to save TDS on SCSS interest income

Senior Citizen Savings Scheme (SCSS) is an attractive scheme for senior citizens which offers 8.2% interest for the July-September quarter. An individual can invest up to Rs 30 lakh in SCSS. Interest earned on the SCSS investment is taxable per the investor’s income tax slab. TDS is also deducted if the interest received from the […]